2025 Mortgage Renewal Canada: Navigating the upcoming renewal period requires careful planning. Canadian homeowners will face a landscape shaped by fluctuating interest rates, economic uncertainties, and various renewal options. This guide breaks down the key considerations, helping you make informed decisions to secure the best possible mortgage terms for your financial future.

Understanding current mortgage rates, predicting future trends, and exploring different renewal options are crucial steps. We’ll delve into the impact of economic factors like inflation and housing market shifts, providing strategies to manage costs and negotiate favorable rates. Real-life scenarios will illustrate the financial implications of various choices, empowering you to confidently approach your 2025 renewal.

Current Canadian Mortgage Rates in 2024

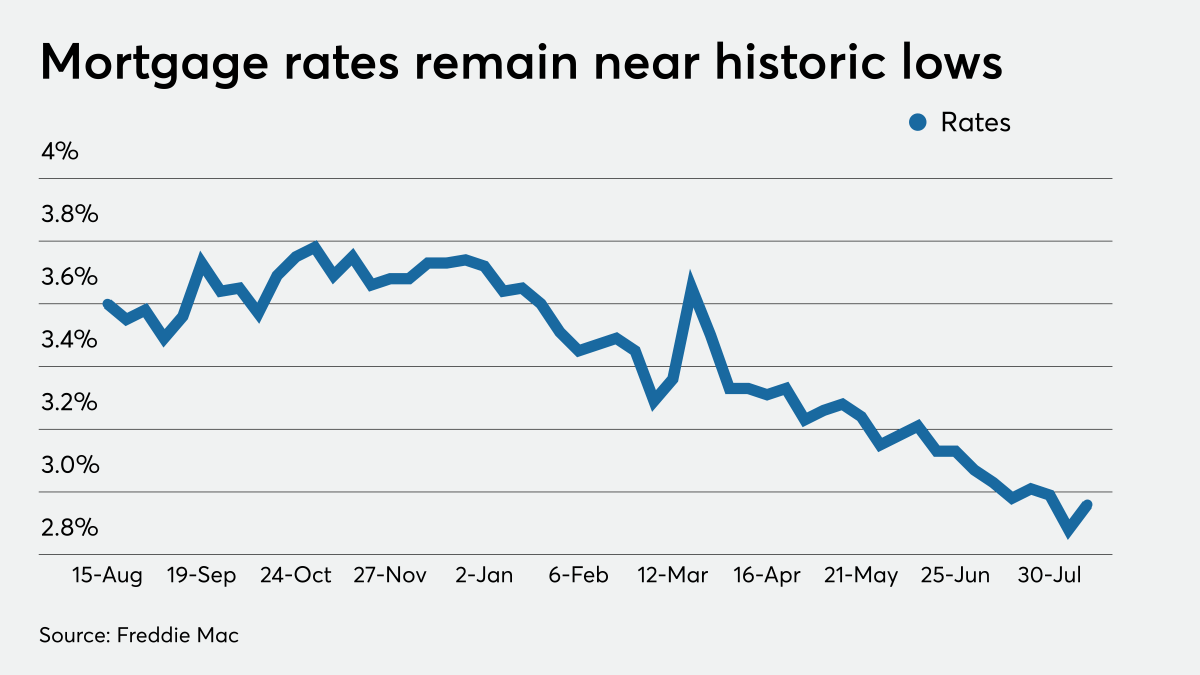

Navigating the Canadian mortgage market in 2024 requires understanding the current landscape of interest rates. Both fixed and variable rates fluctuate, impacting your monthly payments and overall borrowing costs. This section provides a snapshot of current rates and the factors influencing them.

Facing a 2025 mortgage renewal in Canada? Rates are changing, so planning ahead is key. You might need to explore different options, maybe even selling some of your stuff, like that extra drone you bought from kit karzen , to free up some cash. Ultimately, getting a handle on your finances now will make your 2025 mortgage renewal much smoother.

Canadian Mortgage Rate Comparison

The following table offers a comparison of 5-year fixed and variable mortgage rates from some major Canadian banks. Remember that these rates are subject to change and are only a snapshot in time. Always check directly with the bank for the most up-to-date information before making any decisions. It’s crucial to shop around and compare offers from multiple lenders to secure the best possible rate.

| Bank Name | Fixed Rate (5-year) | Variable Rate | Average Rate |

|---|---|---|---|

| Royal Bank of Canada (RBC) | Example: 5.75% | Example: 6.25% | Example: 6.00% |

| Toronto-Dominion Bank (TD) | Example: 5.80% | Example: 6.30% | Example: 6.05% |

| Bank of Montreal (BMO) | Example: 5.70% | Example: 6.20% | Example: 5.95% |

| Canadian Imperial Bank of Commerce (CIBC) | Example: 5.85% | Example: 6.35% | Example: 6.10% |

Factors Influencing Mortgage Rates

Several factors contribute to the fluctuation of mortgage rates in Canada. These include, but are not limited to, the Bank of Canada’s monetary policy, inflation rates, the overall economic climate, and global financial market conditions. For instance, high inflation often leads to increased interest rates as the central bank attempts to control rising prices. Conversely, during periods of economic uncertainty, rates may be lowered to stimulate borrowing and economic activity.

The demand for mortgages also plays a significant role; higher demand can push rates upwards.

Impact of Bank of Canada Interest Rate Decisions

The Bank of Canada’s key interest rate decisions have a direct and significant impact on mortgage rates. When the Bank of Canada raises its key interest rate (the overnight rate), it becomes more expensive for banks to borrow money, leading them to increase their mortgage rates. Conversely, a reduction in the key interest rate generally translates to lower mortgage rates.

For example, if the Bank of Canada increases its overnight rate by 0.25%, we can expect to see a corresponding increase in both fixed and variable mortgage rates, although the exact amount may vary depending on other market factors. The impact is usually felt more acutely on variable rate mortgages, as they are directly tied to the Bank of Canada’s rate.

Predicting 2025 Mortgage Rates

Predicting mortgage rates for 2025 is a complex undertaking, requiring careful consideration of various economic indicators and potential shifts in the financial landscape. While no one can definitively say what rates will be, analyzing current trends and forecasts allows us to develop plausible scenarios. This will help homeowners and prospective buyers better understand the potential range of possibilities and prepare accordingly.Predicting future mortgage rates involves examining several key economic factors.

The Bank of Canada’s monetary policy plays a crucial role. Inflation rates, unemployment figures, and economic growth projections all influence the central bank’s decisions on interest rates. Global economic conditions, such as fluctuations in oil prices or international trade disputes, can also significantly impact Canadian mortgage rates. Furthermore, the overall health of the Canadian housing market, including supply and demand dynamics, affects lenders’ risk assessments and, consequently, the rates they offer.

Planning for your 2025 mortgage renewal in Canada? It’s a big financial decision, so start thinking about it now. Need a break from the numbers? Check out this amazing spectacle: detroit lions drone show , a totally different kind of show! Then, get back to focusing on those mortgage rates and options for your 2025 renewal – you’ve got this!

Analyzing these factors together provides a more comprehensive picture of potential rate movements.

Possible 2025 Mortgage Rate Scenarios

The following table illustrates three potential scenarios for average 5-year fixed mortgage rates in 2025. These are simplified examples and should not be considered financial advice. Actual rates will depend on individual lender policies, credit scores, and the specific mortgage terms. Remember that these are projections based on current economic forecasts and could change significantly based on unforeseen events.

| Scenario | Average 5-Year Fixed Rate (Estimate) | Implications for Homeowners |

|---|---|---|

| Optimistic | 5.0% – 5.5% | Rates remain relatively stable, potentially offering refinancing opportunities for those with higher rates. Homeowners might experience manageable monthly payments. This scenario assumes continued economic growth, controlled inflation, and a stable housing market. For example, if inflation is successfully brought down to the Bank of Canada’s target range, this could lead to lower interest rates. |

| Neutral | 6.0% – 6.5% | Rates remain relatively consistent with current levels, potentially resulting in some pressure on household budgets. This scenario assumes a moderate pace of economic growth, inflation remaining somewhat elevated, and a balanced housing market. A scenario like this might play out if the Bank of Canada maintains a cautious approach to interest rate adjustments, balancing inflation concerns with the need to support economic growth. |

| Pessimistic | 7.0% – 7.5% | Significant increase in mortgage payments, potentially leading to financial strain for some homeowners. This scenario assumes slower economic growth, persistent inflation, and a potential downturn in the housing market. For instance, a global recession could negatively impact the Canadian economy, forcing the Bank of Canada to increase interest rates further to combat inflation. |

Methodologies for Predicting Mortgage Rates

Several methodologies are employed to predict future mortgage rates. These include econometric modeling, which uses statistical techniques to analyze historical data and economic indicators to forecast future trends. Qualitative analysis involves assessing expert opinions, market sentiment, and geopolitical factors. Furthermore, analyzing the Bank of Canada’s policy statements and announcements provides crucial insights into their future intentions regarding interest rate adjustments.

By combining quantitative and qualitative approaches, analysts strive to create a comprehensive forecast. It’s important to remember that these are projections, not guarantees, and unexpected economic events can significantly impact the accuracy of these predictions. For example, an unexpected surge in inflation could lead to higher-than-predicted interest rates.

Renewal Options for Homeowners in 2025

Facing mortgage renewal in 2025? Understanding your options is crucial to securing the best rate and terms. This section breaks down the key choices available to Canadian homeowners, helping you navigate this important financial decision. Remember, rates and options can change, so always consult with your lender or a mortgage broker for the most up-to-date information.

Fixed-Rate Mortgages

A fixed-rate mortgage offers predictable monthly payments for the entire term. The interest rate remains constant, shielding you from interest rate fluctuations during your renewal period. This stability is highly appealing to many homeowners who prefer budgeting certainty. However, if interest rates drop significantly during your term, you’ll miss out on potential savings.

Variable-Rate Mortgages

Variable-rate mortgages are linked to a benchmark interest rate, such as the prime rate set by the Bank of Canada. Your monthly payments will fluctuate based on changes in this benchmark rate. The advantage is that you could potentially benefit from lower payments if interest rates fall. Conversely, if rates rise, your payments will increase, impacting your budget.

This option requires a higher tolerance for risk.

Facing a 2025 mortgage renewal in Canada? Rates are shifting, so smart planning is key. Check out this insightful game changer review – it’s got great tips on managing big financial decisions, which are super relevant when tackling your upcoming renewal. Understanding your options now will help you navigate the 2025 mortgage renewal process smoothly.

Open Mortgages

Open mortgages allow you to pay off your mortgage in full at any time without penalty. This flexibility is valuable if you anticipate needing to sell your home or refinance quickly. However, open mortgages typically come with a higher interest rate to compensate for the lender’s increased risk. This is a good option for those who value flexibility over potentially lower interest rates.

Closed Mortgages

Closed mortgages usually offer lower interest rates than open mortgages. This is because you agree to a set repayment schedule, limiting the lender’s risk. However, breaking your mortgage agreement early often involves hefty penalties. This is suitable for those confident in their long-term plans and who prioritize lower interest rates.

Factors to Consider When Choosing a Renewal Option, 2025 mortgage renewal canada

Choosing the right renewal option depends on your individual circumstances and financial goals. Consider these key factors:

- Your risk tolerance: Are you comfortable with fluctuating payments, or do you prefer the stability of a fixed rate?

- Your financial outlook: Do you anticipate any major life changes (e.g., job loss, unexpected expenses) that might affect your ability to make payments?

- Your long-term plans: Do you plan to stay in your home for the entire mortgage term, or do you anticipate selling or refinancing in the near future?

- Current interest rate environment: Compare current fixed and variable rates to determine which offers the best value.

- The amount of your down payment: A larger down payment may give you access to better rates and terms.

- Your credit score: A higher credit score can significantly impact the interest rate you qualify for.

Impact of Economic Factors on Mortgage Renewals

Renewing your mortgage in 2025 will be significantly influenced by several key economic factors. Understanding these factors and their potential impact is crucial for making informed decisions about your renewal strategy. The interplay between inflation, unemployment, and the housing market will shape the rates and options available to Canadian homeowners.

The Canadian economy, like many others globally, is navigating a complex landscape. Several interconnected factors will influence the cost of borrowing and the overall health of the housing market, directly impacting your mortgage renewal in 2025. Let’s examine some of the most significant ones.

Rising Inflation’s Effect on Mortgage Payments

Rising inflation directly impacts mortgage payments, primarily by increasing the Bank of Canada’s policy interest rate. Higher interest rates translate to higher borrowing costs. For example, if inflation remains elevated, leading to a further increase in the benchmark rate, your renewal rate could be substantially higher than your current rate. This means your monthly mortgage payment will increase, potentially impacting your household budget.

The magnitude of this increase will depend on several factors including the length of your new mortgage term and the difference between your old and new interest rates. Homeowners should carefully analyze their budgets and explore various mortgage options to minimize the financial burden of higher payments.

Housing Market Trends and Renewal Strategies

Changes in the housing market significantly influence homeowners’ renewal strategies. A cooling market, characterized by decreasing home prices and slower sales, might offer opportunities for refinancing at lower rates or even downsizing to reduce mortgage burden. Conversely, a buoyant market with increasing home values could incentivize homeowners to stay put and potentially leverage their increased equity for home renovations or other investments.

The current state of the housing market will influence the overall desirability of your property, potentially affecting the terms you can negotiate during your renewal. For instance, a homeowner in a rapidly appreciating market might find it easier to negotiate better terms compared to someone in a stagnating or declining market.

Strategies for Managing Mortgage Renewal Costs

Facing a mortgage renewal can feel daunting, especially in a fluctuating economic climate. However, proactive planning and strategic action can significantly ease the burden and help you secure the best possible terms. This section Artikels practical steps to manage your renewal costs effectively.

Preparing for Your 2025 Mortgage Renewal

A successful renewal starts well in advance. Begin the process at least three months before your current mortgage term ends. This allows ample time to compare rates, explore options, and negotiate effectively. First, gather all relevant documentation: your current mortgage statement, your credit report, and any other financial documents that demonstrate your financial stability. Next, assess your current financial situation.

Understand your income, expenses, and debt levels. This clear picture will inform your negotiation strategy and help you determine your affordability. Finally, start researching different lenders and mortgage options. Don’t limit yourself to your current lender; explore other banks, credit unions, and mortgage brokers to compare rates and terms.

Negotiating Lower Mortgage Rates

Negotiating a lower rate isn’t always easy, but it’s often possible. A strong financial position is your best bargaining chip. A high credit score, a consistent payment history, and a low debt-to-income ratio will significantly improve your negotiating power. Be prepared to shop around and present competing offers from other lenders. This demonstrates your commitment to securing the best deal and encourages your current lender to be more competitive.

Consider increasing your down payment or shortening your amortization period to improve your chances of a lower rate. Remember, politeness and professionalism go a long way in negotiations. Clearly articulate your needs and expectations while maintaining a respectful dialogue. For example, if you’ve been a loyal customer with a strong payment history, highlight this to your lender.

Resources for Homeowners Facing Financial Challenges

Unexpected financial difficulties can impact your ability to manage mortgage renewals. Several resources are available to help homeowners navigate these challenges. Credit counselling agencies offer guidance on budgeting, debt management, and exploring options like debt consolidation. Government programs, such as the Canada Mortgage and Housing Corporation (CMHC) programs, may provide financial assistance or support for homeowners facing hardship.

Your lender may also offer hardship programs, including temporary payment deferrals or modifications to your mortgage terms. It’s crucial to contact these agencies or your lender as soon as you anticipate potential financial difficulties. Early intervention is key to preventing foreclosure and finding suitable solutions. For example, if you’ve experienced a job loss, immediately contact your lender to discuss your situation and explore potential options.

They may be able to work with you to create a manageable repayment plan.

Illustrative Examples of Mortgage Renewal Scenarios: 2025 Mortgage Renewal Canada

Understanding your options during a mortgage renewal is crucial for long-term financial health. The best strategy depends heavily on your individual circumstances, risk tolerance, and financial goals. Let’s examine three distinct scenarios to illustrate this point. Remember, these are examples, and your specific situation may require personalized advice from a financial professional.

Facing a 2025 mortgage renewal in Canada? You’ll want to be financially savvy, and that means exploring different avenues. Thinking about how to boost your income? Check out opportunities like those at business expos, which can offer insights into new markets and potentially higher-earning ventures. Ultimately, securing your financial future before your 2025 mortgage renewal is key.

Scenario 1: The Conservative Homeowner

This homeowner, let’s call her Sarah, has a $300,000 mortgage with 15 years remaining on a 30-year amortization. She’s risk-averse and prioritizes stability over potentially lower rates. Current rates are at 6%, but she anticipates some fluctuation.

- Current Situation: $300,000 mortgage, 15 years remaining amortization, 6% interest rate. Monthly payment is approximately $2,387.

- Renewal Strategy: Sarah opts for a 5-year fixed-rate renewal at 6.25%. While slightly higher than her current rate, this provides predictable payments for the next five years.

- Impact: Her monthly payment will increase slightly to approximately $2,420. The overall cost over five years will be higher than if she found a lower rate, but the predictability mitigates risk.

- Long-Term Implications: Sarah maintains financial stability, avoiding potential rate shocks. She pays slightly more, but the predictability allows her to better budget and plan for the future.

Scenario 2: The Rate-Sensitive Homeowner

Mark, on the other hand, is comfortable with a bit more risk. He has a $450,000 mortgage with 20 years remaining on a 25-year amortization and a current rate of 5.75%. He’s hoping rates will decline in the near future.

- Current Situation: $450,000 mortgage, 20 years remaining amortization, 5.75% interest rate. Monthly payment is approximately $3,264.

- Renewal Strategy: Mark chooses a 1-year variable-rate mortgage. He anticipates that rates might decrease within the next year, offering potential savings.

- Impact: His monthly payments could decrease if rates fall, but they could also increase if rates rise. The uncertainty is a trade-off for the potential savings.

- Long-Term Implications: Mark’s strategy offers the possibility of significant savings if rates drop, but he faces the risk of higher payments if rates climb. He needs to be prepared for payment fluctuations.

Scenario 3: The Aggressive Homeowner

Let’s consider Lisa, who has a $250,000 mortgage with 10 years remaining on a 15-year amortization and a current rate of 6.5%. She’s in a strong financial position and is willing to explore options to reduce her overall mortgage debt quickly.

- Current Situation: $250,000 mortgage, 10 years remaining amortization, 6.5% interest rate. Monthly payment is approximately $2,714.

- Renewal Strategy: Lisa chooses a 5-year fixed-rate mortgage at 6.75% but increases her monthly payment by $300. This will significantly shorten her amortization period.

- Impact: Her monthly payments will be higher ($3014), but she will pay off her mortgage substantially faster, reducing the total interest paid over the life of the loan.

- Long-Term Implications: Lisa will be mortgage-free sooner, saving significant interest payments in the long run. However, she needs to ensure she can comfortably manage the increased monthly expenses.

Epilogue

Successfully navigating your 2025 mortgage renewal in Canada hinges on proactive planning and a clear understanding of your options. By carefully considering current rates, predicting future trends, and exploring various renewal strategies, you can secure the best possible terms for your financial well-being. Remember to leverage available resources and don’t hesitate to seek professional advice to ensure a smooth and financially sound renewal process.

Being prepared empowers you to make confident decisions and secure a mortgage that aligns with your long-term financial goals.

FAQ Section

What factors influence mortgage rates in Canada?

Bank of Canada interest rate decisions, inflation, economic growth, and overall market conditions significantly influence mortgage rates.

Can I refinance my mortgage before renewal?

Yes, refinancing allows you to potentially secure a better interest rate or change your mortgage terms before your renewal date. Check with your lender for fees and requirements.

What if I can’t afford my renewed mortgage payments?

Contact your lender immediately to discuss options like extending your amortization period, switching to a lower payment plan, or exploring government assistance programs.

What’s the difference between a fixed and variable rate mortgage?

Fixed-rate mortgages have a consistent interest rate throughout the term, while variable rates fluctuate with the Bank of Canada’s prime rate. Fixed rates offer predictability, while variable rates can potentially be lower initially.